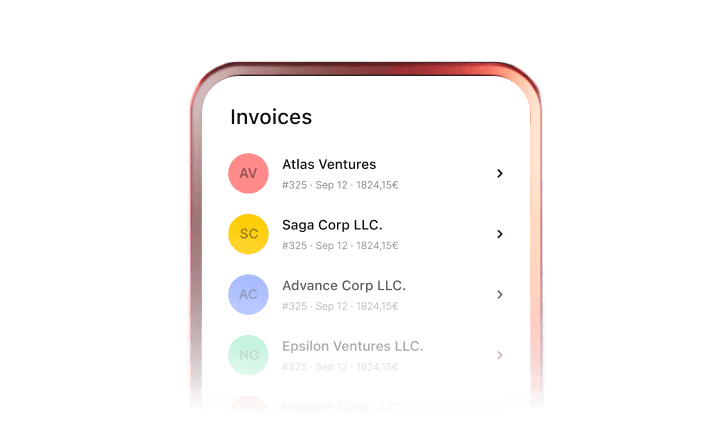

Say hello to invoicing

made easy

No more searching for QR codes.

No more confusing software.

One invoicing super-tool to supercharge your business.

Excellent

4.8 out of 5

Trustpilot

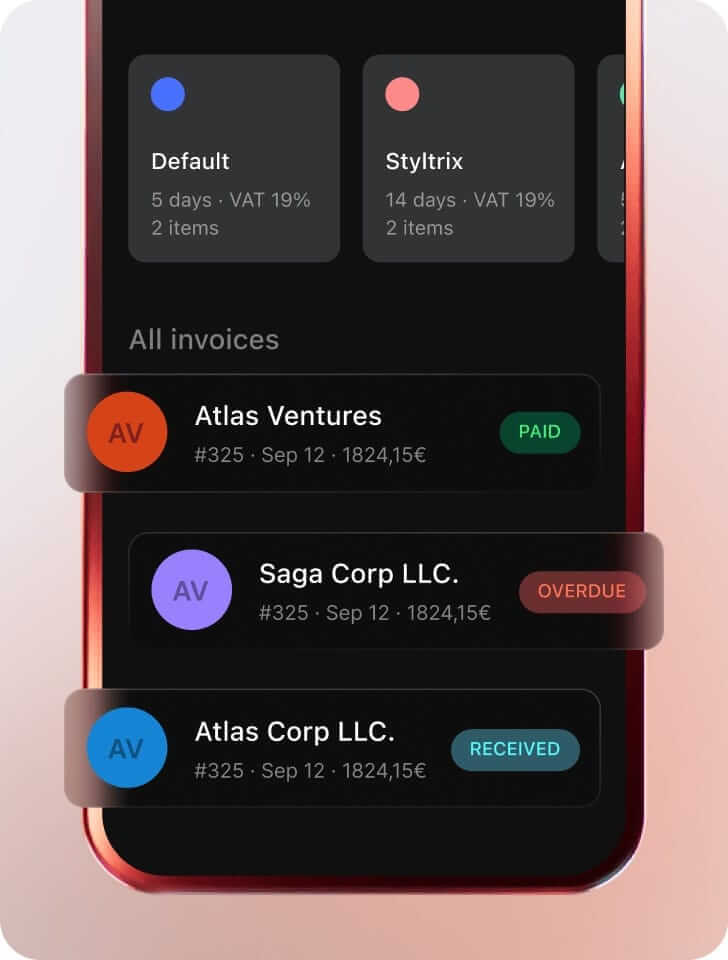

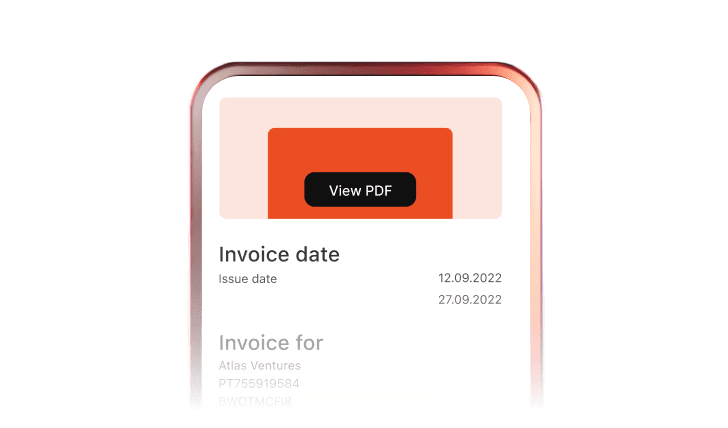

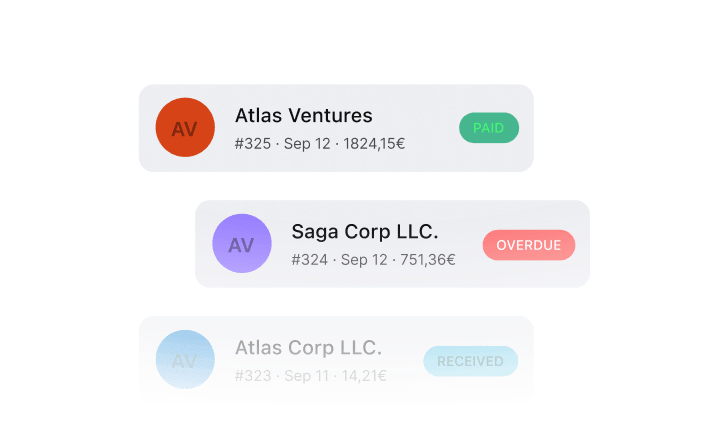

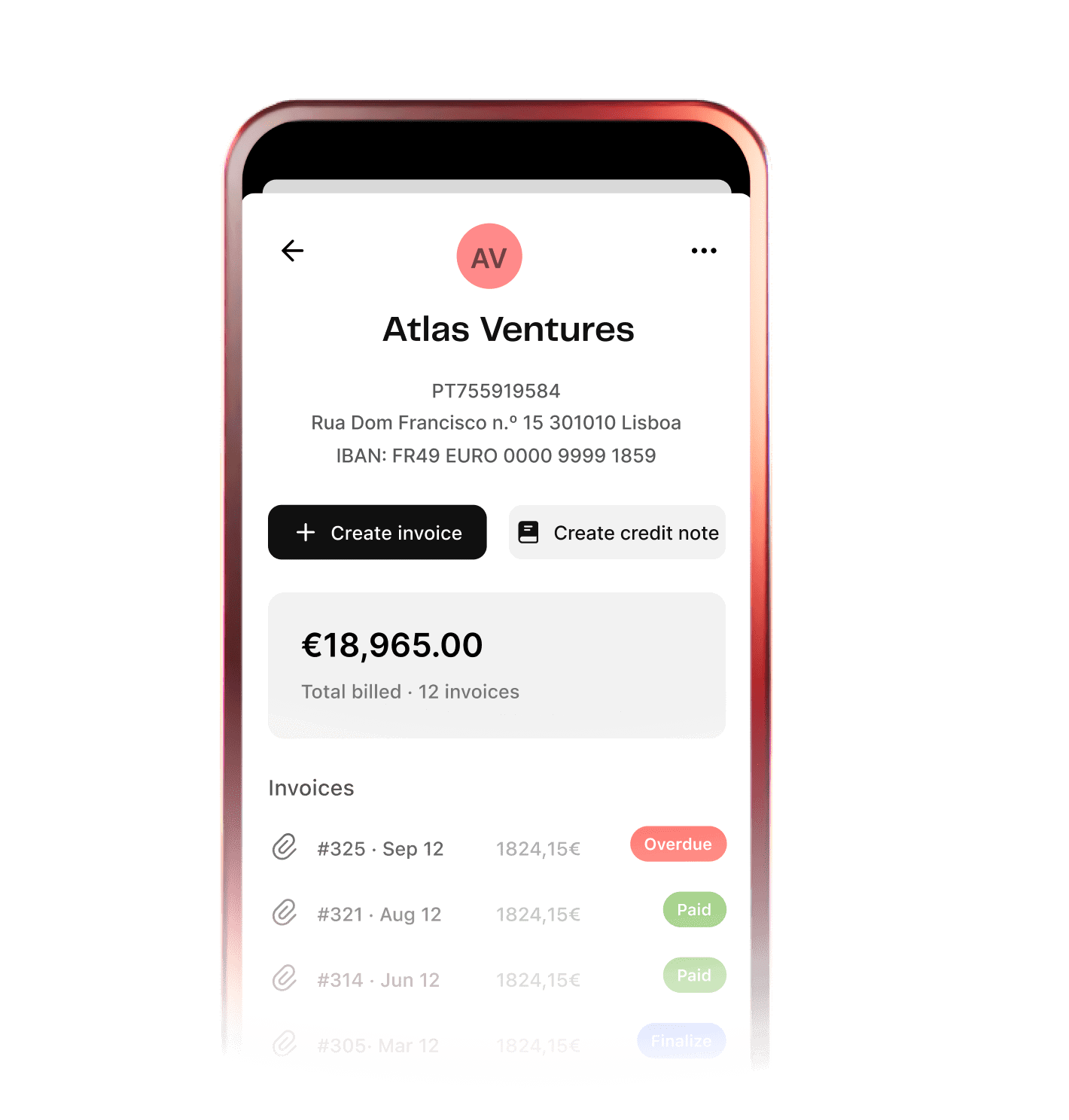

It’s complicated, confusing and time-consuming to send certified invoices in Portugal. For B2B e-invoices, you have to apply for a unique series of invoice numbers from the government in advance of issuing an invoice.

Then you need to use certified software to produce a QR code on each invoice, including an ATCUD code.

Rauva does all of this for you. In one easy-to-use app.