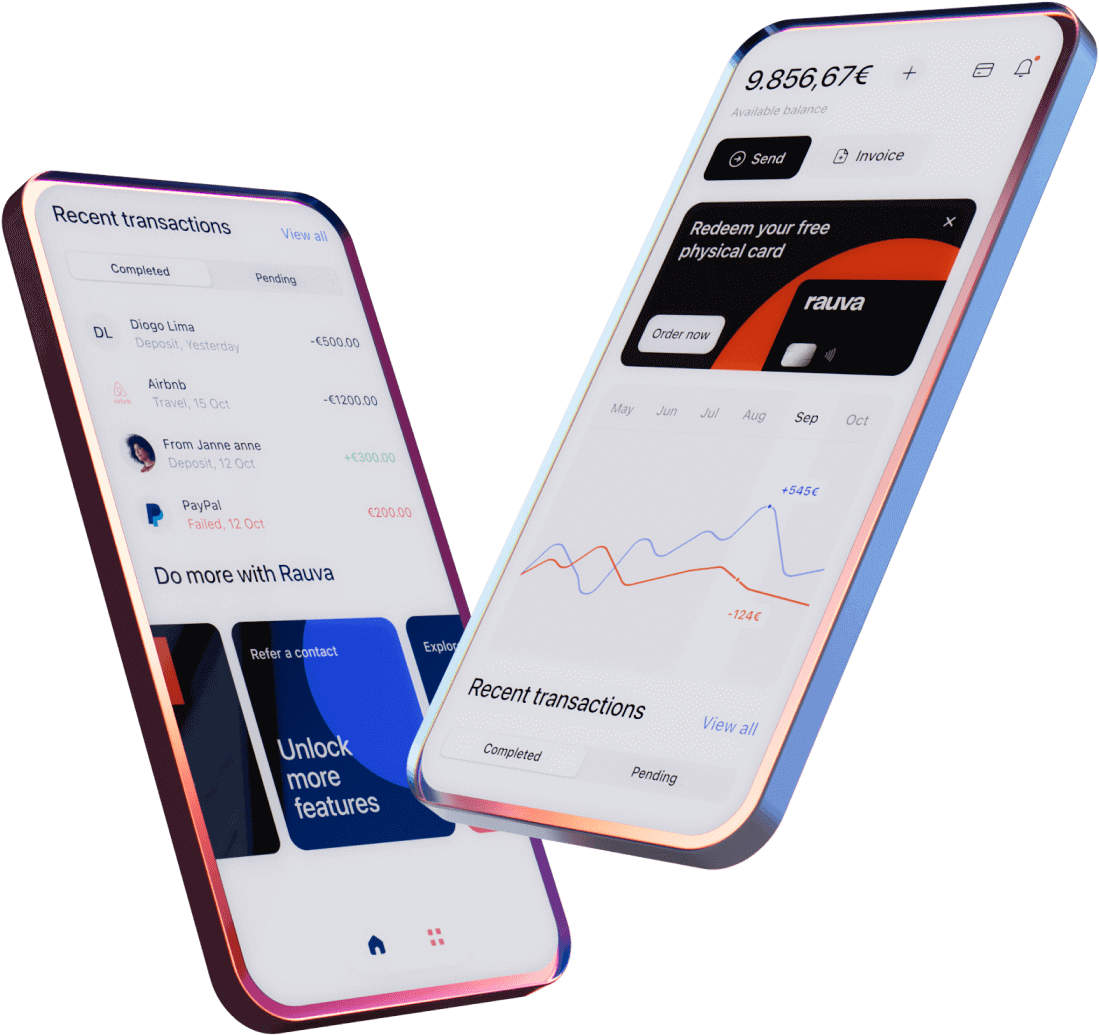

A secure business account from your phone.

In minutes.

- Open an account online in minutes

- Make international transfers in 40 currencies

- Have an European IBAN

- Free and instant SEPA payments, unlimited

- Get a debit card in the post and instant virtual debit cards

Excellent

4.8 out of 5

Trustpilot

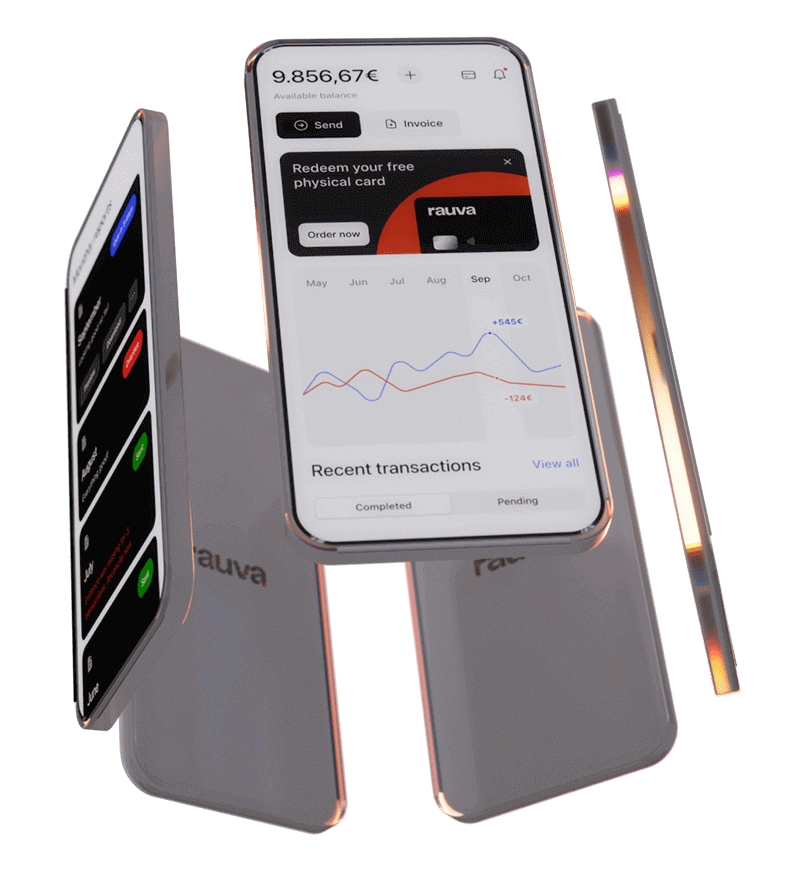

The business account built for Portugal

Fast

Open an account in minutes. From your phone. 100% online.

Transparent

Low cost. No hidden fees.

Cancel at anytime.

Secure

Our banking partners are regulated by the European Central Bank (ECB).

Supported

Speak to a highly knowledgeable

and responsive support team.

Your funds. Protected. Safe.

Rauva´s banking partners are regulated by the European Central Bank (ECB). The safest way to store your funds in Europe and protected with maximum security.

Free physical and virtual debit cards

- Cash withdrawals in Portugal and across the EU

- Simple card activation

- Control spending per country

- Control e-commerce spending

- Easily cancel and order new cards

The features you asked for

- SEPA payments

- Manage and track direct debits

- Virtual and physical card payments

- Email and push notifications

- Categorise transactions and expenses

- Add notes to transactions and expenses

Open your business account. Fast. Easy.

From your phone.

1

Download the Rauva app

2

Upload your documents in minutes

3

Get verified in a couple of hours